MARKET OVERVIEW

The commercial casualty insurance marketplace has been impacted by several factors in recent years. These factors include current global economic conditions, well-financed plaintiff bars and subsequent large settlements and jury verdicts. The present casualty rate environment has become more stable, and pricing has moderated following the recent period of rate tightening, dramatic corrections and reductions in carrier line size deployments. Overall, we find prices are still increasing, but the increases have in our view become more predictable.

Over the last year there has been an influx of new casualty insurers and MGAs with significant growth targets. These new players are increasing competition, although we are seeing capacity constraints remain for certain industry and product line sectors. Even though pandemic conditions have eased, the backlogged U.S. court systems are contributing to accelerated claim activity. Underwriters and their senior management remain concerned over continuous and rising claims coupled with the broader economic and regulatory factors, especially from the influence of rising inflation and interest rates. Inflation is taking on many forms (economic, social, and medical) and making a direct impact on rising claims severity and settlement costs.

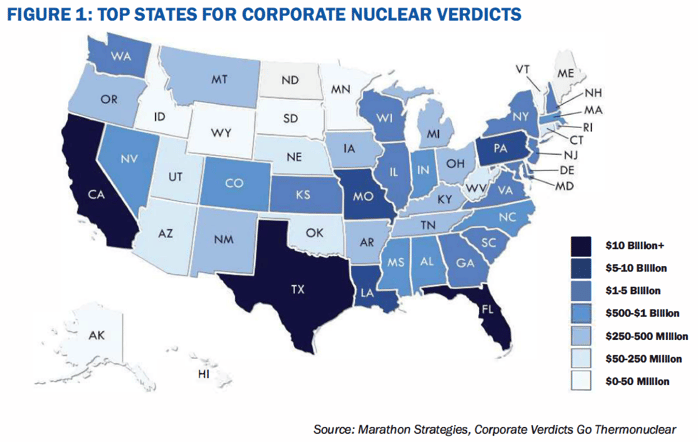

The rising severity of claims is in our view driven by the combination of third-party litigation financing, increasing medical costs and the increasing number of nuclear verdicts year over year. See Figure 1 for the top states for corporate nuclear verdicts.

MARKET IMPACT

In our experience, insurers are maintaining a disciplined approach attempting to target rate adequacy and acceptable profitability, especially for challenging risks where rates remain strained. Their pricing models for general and product liability continue to show moderate upward adjustments but are less severe than other casualty lines. In this more competitive rate environment, we are seeing that pricing has become even more favorable for insureds that are in preferred classes of business with favorable loss history. Other factors in our view softening the effect of higher pricing have been insureds assuming more risk with the application of higher deductibles and SIRs in recent years.

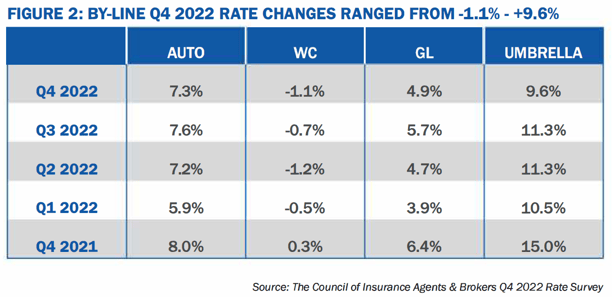

We are seeing industries with exposures and accounts containing poor loss histories continue to face challenging casualty renewals. This also includes insureds with difficult product risk such as auto parts, medical devices and chemicals, as well as insureds with higher premises risk such as multi-family owners and property managers. The increase in rates has decelerated quarter over quarter over the past year. We believe this trend can be attributed to insurers now achieving closer rate adequacy, experiencing increasing competition and packaging more of the insureds' insurance lines with the lead carrier for price discounts. See Figure 2.

Depending on the account size, loss history and overall risk factors, we have observed some insurers starting to offer higher deployment of their limit capacity, lower attachment points and improved pricing. Lead carriers are still primarily managing limits of $5 million, but some of the new excess carriers are starting to make increased limit alternatives available. There continues to be a high demand for buffer markets placed between the primary and lead umbrella carriers. More carriers are willing to negotiate on price rather than decline the risk based on its perceived unprofitability.

As new binding authority entrants look to gain market share, we have seen in the past that they may entertain some distressed classes and not take a one-size-fits-all approach. We saw this occur prior to the hard market. For the larger casualty accounts, increased interest remains in alternative risk transfer solutions, such as captives and structured market deals. Ryan Specialty offers a solution through Keystone Risk Partners who work with brokers to provide alternatives to traditional insurance capacity in the E&S markets or deliver financial solutions to insurance challenges that are not properly served by conventional market arrangements.

REINSURANCE

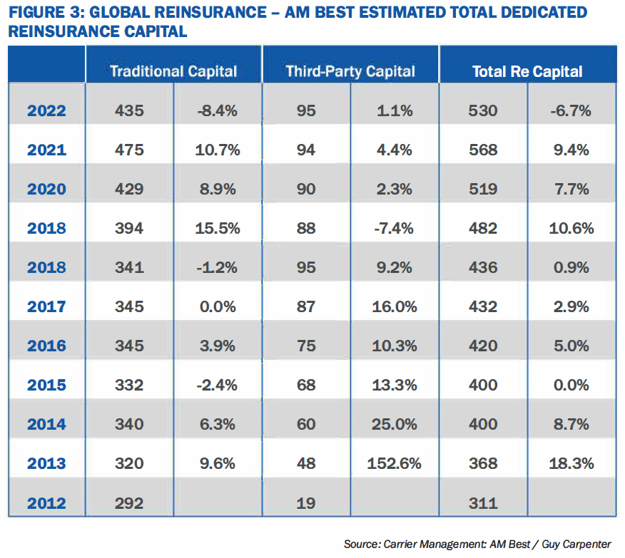

There has been a reduction in overall global capacity compared to recent years. See Figure 3.

Rates are increasing in the reinsurance marketplace across all property and casualty lines. The recent January 1 reinsurance treaty renewals reflected a significant upward trend in pricing over the prior period. This trend is expected to continue through the coming mid year negotiations.

SPOTLIGHT- PRIMARY/ EXCESS AUTO NEEDS

Coming out of the pandemic has had a mixed impact on commercial auto risk. In contrast to reductions in overall commercial vehicle usage, there is an increase in reliance on transit deliveries. In addition, social inflationhas impacted the commercial auto insurance market. This is mainly due to in our view to adverse loss trends, including a surge in lawsuits and associated settlements. Nuclear verdicts (where jury awards exceed $10 million) have been on the rise.

Organizations with large transportation fleets continue to face the challenging task of filling out their excess liability towers. Program limits remain reduced compared to prior softer market periods. Bermuda and certain domestic U.S. markets are beginning to re-enter the market to compete on the higher excess layers, but pricing remains elevated. Fleets with adverse risk profiles may also require increased levels of self-insured quota-share participation within the umbrella / excess program tower and higher underlying primary attachment points.

What we are seeing is the insurers specializing in underwriting larger fleets tend to differentiate the accounts that deploy the use of technology for achieving improved safety results. Telematics provides a digital blueprint of every aspect of a vehicle's operation. This technology has become a critical tool for fleet managers to understand where improvements can be made in accident prevention measures and driver safety standards. The use of telemetric methods for the collection of data on driver behavior and overall vehicle usage has allowed underwriters to improve their accuracy with risk assessment, in addition to providing positive reinforcement for driver training and other risk mitigation programs.

Recent reports released by the Federal Highway Traffic Safety Administration confirmed vehicle fatalities have jumped upward since 2021. Road incidents that result in severe injuries also contributed to elevated accident expenses and further increased auto claim costs. We believe these factors, combined with various car shortages, rising labor expenses and inflated vehicle pricing, have led to prolonged repair times and overall surging claim costs.

ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG)

For all casualty lines of business, many carriers are increasingly adopting underwriting standards that address ESG concerns. Insurance companies are becoming more aware of the importance of addressing ESG issues in their underwriting standards. More insurers will cease underwriting for certain industries or individual insureds whose poor product safety and quality negatively impacts customer health, causes environmental degradation or has other risks that carry a negative social perception. Insurers will seek to develop products that have a more positive impact on ESG issues and encourage better risk management.

SUMMARY

Over the last two years, the E&S casualty market has continued to address these challenges by facilitating several new market entrants and creating a more competitive environment. The annual 2022 Wholesale

& Specialty Insurance Association (WSIA) Stamping Office Premium and Transaction Report confirms a 24.1% growth rate of total surplus lines premium reported to the stamping offices for 2022. This represents the largest year-over-year rate in stamping office premium since the association began recording data in 2009.

RT Specialty casualty brokers focus on providing clients with options for cutting-edge solutions in a collaborative environment.

Especially in today's challenging market, it is critical for insureds to work closely together with both their retail broker and wholesale trading partner. RT Specialty recommends retail agents and brokers consider implementing these steps:

- Prepare early for renewal, develop a plan of action and identify both incumbent

and new markets to evaluate capacity capabilities, pricing, terms and conditions, including potential issues with any exclusionary wordings. - Present high-quality and accurate market information/ submissions to positively differentiate the insured's risk quality. Depending on the particular risk, underwriters may want to see the safety strategies, contractual risk management, risk mitigation, capital expenditures, willingness to engage in risk control and overall risk management philosophy.

- Analyze potential risk financing alternatives, utilizing data analytics to evaluate whether current program provides the cashflow, retention level, cost and collateral perspectives the insured is looking for.

- Determine as early as possible the minimum underlying limits that the umbrella markets will attach above and work with the primary insurers or buffer markets accordingly.

- Do a cost-benefit analysis of assuming separate levels of self-retention versus guaranteed costs or low deductible alternatives.

- Review umbrella/ excess aggregate drop-down provisions.

RT Casualty strongly recommends starting renewal planning early to allow adequate time for the evaluation, development and vetting of a comprehensive renewal strategy. High quality, detailed risk descriptions and a comprehensive loss history will likely be required with all underwriting submissions, and RT Casualty can assist its retail brokers in the preparation for renewals and new business negotiations. As a result, our retail agent and broker clients will be in an excellent position to receive favorable pricing and coverage response from the current marketplace.

RT Specialty is a division of RSG Specialty, LLC, a Delaware limited liability company based in Illinois. RSG Specialty, LLC, is a subsidiary of Ryan Specialty Group, LLC. RT Specialty provides wholesale insurance brokerage and other services to agents and brokers. As a wholesale broker, RT Specialty does not solicit insurance from the public. Some products may only be available in certain states, and some products may only be available from surplus lines insurers. In California: RSG Specialty Insurance Services, LLC (License #0G97516). ©2023 Ryan Specialty Group, LLC

RT Casualty's Review Newsletter is provided for general information purposes only and represents RT Casualty's opinion and observations on the current outlook of the US Casualty Insurance market and does not constitute professional advice. No warranties, promises, and/or representations of any kind, express or implied, are given as to the accuracy, completeness, or timeliness of the information provided in this Article. No user should act on the basis of any material contained herein without obtaining professional advice specific to their situation.