MARKET OVERVIEW

Overall pricing within the property arena has continued its upward trend, along with limited capacity offerings in certain classes of risk. These conditions are especially indicative within the excess and surplus lines property market in comparison to the standard property market, where premium increases have been moderating. In addition to the catastrophe exposed regions that have traditionally been highly susceptible to coastal named storm, flood, convective storm, earthquake and wildfire, the geographical boundaries that require more underwriting scrutiny are expanding. Over the last year, areas throughout Florida, Texas and Louisiana have been most impacted, with more carriers declining risks or only writing business based on meeting rigorous underwriting terms and restrictions. Insureds with adequate protection features, a risk management commitment, a good loss experience and a location in a favorable loss-exposed region can differentiate themselves and achieve more favorable results. These overall market conditions are expected to continue throughout the remainder of 2022.

As reported in the prior RT Property Insurance Review, insurers within the standard market segment continue to reposition their portfolios and reduce writings where losses have impacted results. This adjustment has fueled the surge in premium growth and expansion for the excess & surplus lines market. According to the Wholesale & Specialty Insurance Association (WSIA) Stamping Office Premium and Transaction Report - Midyear 2022, for the first half of 2022, the total surplus lines premium reported to the stamping offices represented a 32.4% increase over the same period in 2021. Transactions increased by 9.4% during the year compared to the year prior. In addition, AM Best Information Services reports the "total US surplus lines direct premiums written (DPW) reached a record $82.6 billion in 2021, with momentum continuing through midyear 2022."

MARKET DRIVERS

Overall property insurance capacity remains adequate yet often requires additional markets within a placement to meet the demand, especially for larger shared and layered programs. Pricing increases on non-CAT accounts has to some extent moderated within the single-digit range, yet tougher classes of business are still receiving significant rate increases. For certain geographically exposed areas such as Tri-County Florida (Palm Beach, Broward, Miami-Dade), Texas, Louisiana and states which are susceptible to wildfire exposed areas, carriers have reduced or even withdrawn their capacity.

Several key primary and excess markets are now only offering net line capacity. Among other reasons, this can be a result of reduced capacity available from facultative or treaty reinsurance markets. The average capacity line size, which may have previously been $10 million, is now most likely reduced to $5 million, with more distressed business possibly reduced to $2.5 million. In addition, many excess carriers have increased scrutiny over attachment points. These reduced line sizes or changes of attachment may require the placement of shorter compressed layers or the need for additional buffer layers, which can drive total premium upward to complete account placement structures.

Excess and buffer layers have become more challenging to place on various accounts driven by reduced line size and the need for additional market participation. In contrast, primary layers have sometimes become more achievable with higher premiums driving participation from players such as London and other offshore markets, who have become more aggressive with the incentive to obtain higher rate levels.

In addition to paying close attention to geographically CAT exposed areas, many key carriers are closely monitoring portfolio growth and aggregation of risk based on type and class of business. Multi-family residential business remains in a tightening market, driven by various primary and excess markets reducing their writings in this space. Other challenging classes of business continue to be warehousing, complicated manufacturing and recycling operations, especially those with a significant loss history. Detailed account information along with full loss inspection reports are often required for any consideration. In addition, with the increase in loss frequency and severity on water damage claims, we expect carriers will continue to focus on closely underwriting this peril, possibly placing lower sub-limits and higher deductibles on this segment of the account.

VALUATION SPOTLIGHT

Insurers have been scrutinizing and challenging property valuations for several renewal cycles due to COVID-19-related supply chain disruptions and skilled labor shortages, among other concerns. The US Bureau of Labor Statistics August 11, 2022 Producer Price Index reported a 25% increase in construction material prices in 2021, with additional increases shown through June 2022. Continued restoration of the supply chain has made some impact; however, it is offset to some degree by the recent uptake in new construction.

With generally high inflation in the US economy, it is important for properties to be accurately valued. Several carriers are taking an aggressive stance against perceived undervaluation by adjusting rates. Policy limits on undervalued properties (particularly as inflation drives up the cost of post-loss repair) might be inadequate in the event of a significant loss. Other actions being taken by carriers to ensure adequate Total Insured Values (TIV) include establishing minimum thresholds and adding policy language regarding coverage being restricted to the declared values shown on the insured’s statement of values.

REINSURANCE

Reinsurance treaty renewals for the first half of 2022 continued with tightening conditions within the property arena. In order to obtain favorable renewal terms, cedent insurers must differentiate their positive underwriting results from others who have been impacted by poor loss results. Reinsurance rates continue to rise, a trend continuing from the sharp jump in pricing seen earlier on the January 1 treaties. Nearly all companies, regardless of profitability, will likely experience increases in reinsurance pricing. Profitable companies will receive more favorable terms, yet the degree of the increase will be based upon additional factors that offset profitability.

In addition to claim performance of the underlying portfolio, the strength of carrier management, business strategy and adequacy of pricing structure, additional key parameters include underwriting guidelines on a go-forward basis and engineering expertise. Reinsurers are looking to support companies who can also demonstrate

proper insurance to value within their portfolio, show expertise in loss control and assure that current challenges (such as climate change, supply chain issues and inflation) are proactively being addressed.

Current high inflation and supply chain disruptions have created additional strain on the reinsurance market. As a result, reinsurers are assessing the impact it represents with their cedent portfolios and making appropriate adjustments to pricing models. Coverage clarity remains a focus with reinsurance renewal negotiations. The emphasis has shifted away from the pandemic after two years of modifications to property policy forms, the crisis in Ukraine and the minimization of any unexpected coverage of risks.

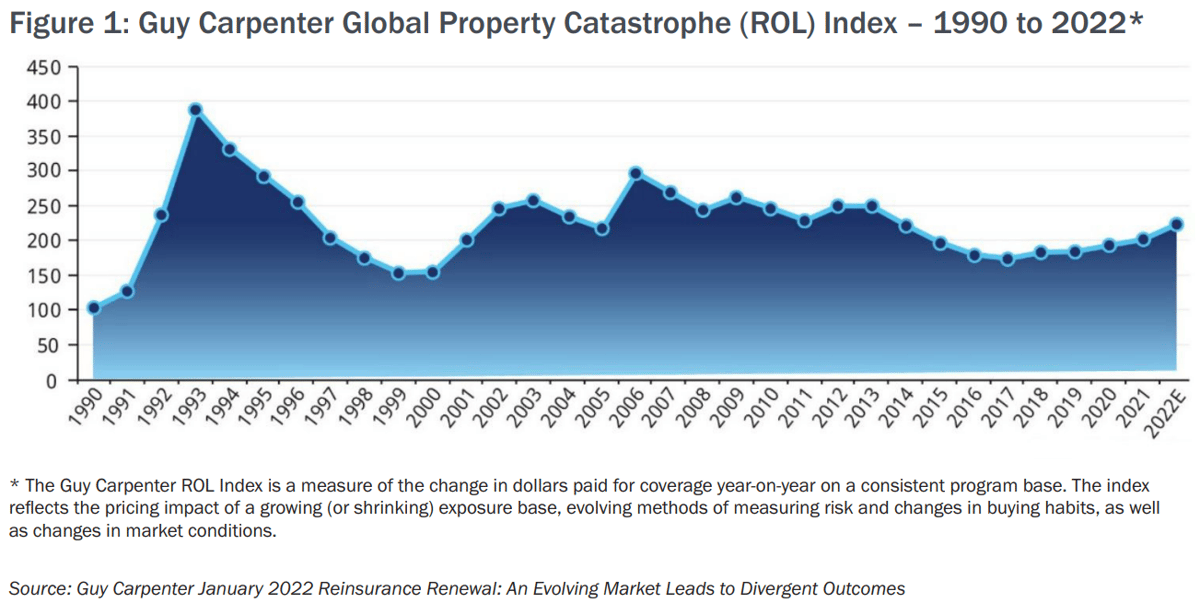

Named windstorm (NWS) in particular has been a big driver of shrinking reinsurance capacity, with increased pricing year-over-year for July 1, 2022 treaty renewals within this segment. Overall, all sectors of property reinsurance pricing have accelerated because of less dedicated capital and few newer entrants. Guy Carpenter estimates a rise of 15% for its catastrophe rate-online index as of mid-year 2022. This rise represents the largest increase for this index since 2006. The continued volatility with property catastrophe exposures in recent years has also driven reinsurers to begin repositioning their portfolios towards other classes, such as casualty lines. Property reinsurers have been in a prolonged period of lackluster results, even when their cedent clients are making money. As an industry, it is important to remain attractive to capital providers. Therefore, results will need to continue to improve through enhanced pricing and client selectivity.

See Figure 1 below for the Guy Carpenter graph which illustrates their updated global Catastrophe Rate-On-Line (ROL).

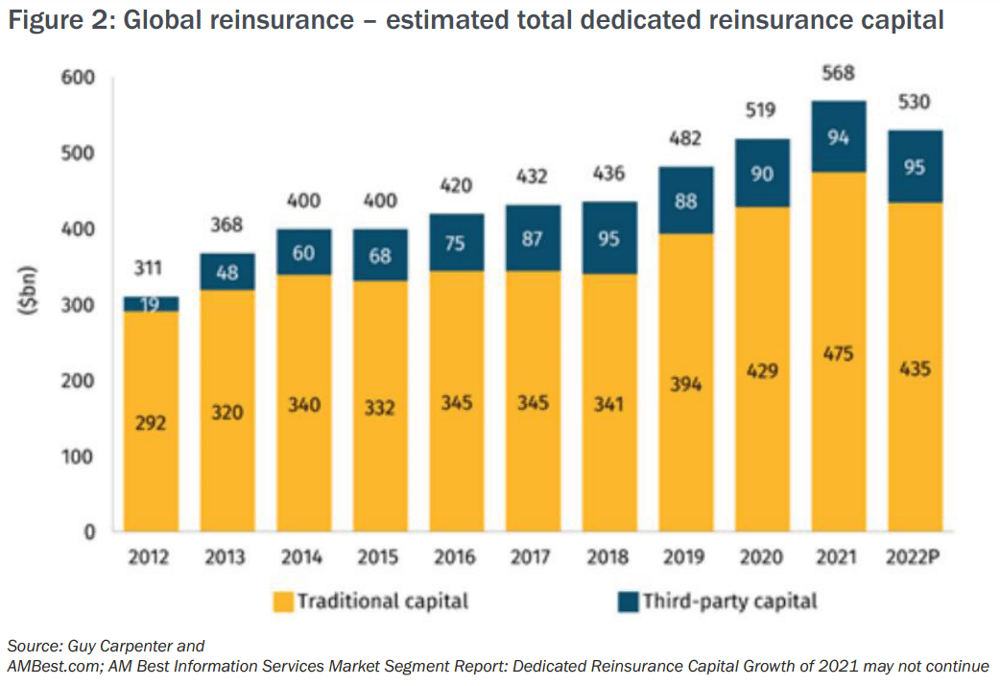

Guy Carpenter and A.M. Best recently released a report which evaluated the global reinsurance marketplace and has projected a possible capacity crunch for property CAT business. The latest forecast for dedicated global reinsurance capital estimates a projected total of $530 billion at year end 2022, compared with $568 billion at the close of 2021. See Figure 2.

BUILDER’S RISK SPOTLIGHT

Residential new construction is expected to continue expanding over the coming year. There is still a degree of ongoing supply chain challenges, shortages of building materials and a lack of skilled labor that are driving up construction prices, yet these factors seem to have moderated slightly over recent months. In addition, there has been an increase in “shovel-ready” infrastructure development and solar renewable energy projects as a result of the investment incentives with federal legislation passing in November 2021.

Available capacity within the builder’s risk insurance market is generally keeping up with demand, yet can be an issue depending on project size, geographical location, CAT exposure and type of construction. Several markets have withdrawn from participating in larger projects and, with very few new entrants coming into the market, premiums have been continually on the rise. Larger projects may require a multi-carrier placement (layering or quota share) to meet policy limit requirements. There is a potential of capacity becoming even more scarce in Q4 as various carriers are beginning to reach premium caps for some slips.

Another challenge is carrier responses to policy term extensions. Labor challenges and material supply chain delays have created the need to extend policy terms beyond original estimated completion dates. In many cases, carriers will require the issuance of new terms with higher rates when asked to extend a coverage period. In some cases, inflation has resulted in higher total project values thereby requiring higher coverage limits on extension, which can cause capacity issues for underwriters who may have used their entire capacity at inception.

Protective safeguards have become more standard and typically are incorporated as mandatory requirements with builder’s risk quotations. Common underwriting recommendations include third-party monitored video surveillance with requests for upfront documentation (i.e., Geotech, budgets, site plans) on the larger projects. Within the builder’s risk market, renovations with existing structures have also become a challenging risk to place in the market. Several carriers no longer offer builder’s risk coverage. Similar to stand-alone larger projects, upfront documentation, including loss control engineering reports and prior inspections, are key to responding to

underwriting requirements.

Within the frame construction space, the builder’s risk market continues to experience large fire losses, including the Oklahoma City fire in February, which made national news. While not as newsworthy, water damage and intrusion losses have become another key topic of discussion, with significant water damage losses becoming too frequent for insurer comfort. Markets have now begun limiting coverage for water damage unless water loss mitigation technology is in place. In addition, there is currently increased demand for “sprawl projects” in the southwestern US, with many projects being developed within very high-hazard brush areas. For underwriters, brush remediation plans prior to construction have become compulsory for successful placements.

HURRICANE SEASON SPOTLIGHT

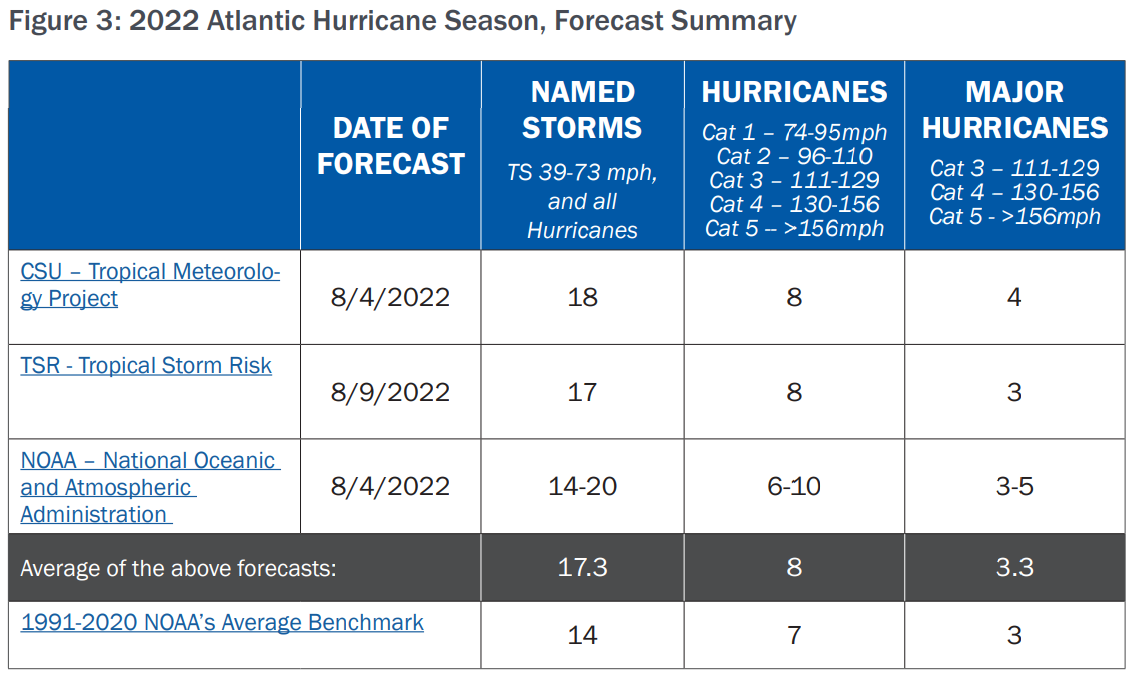

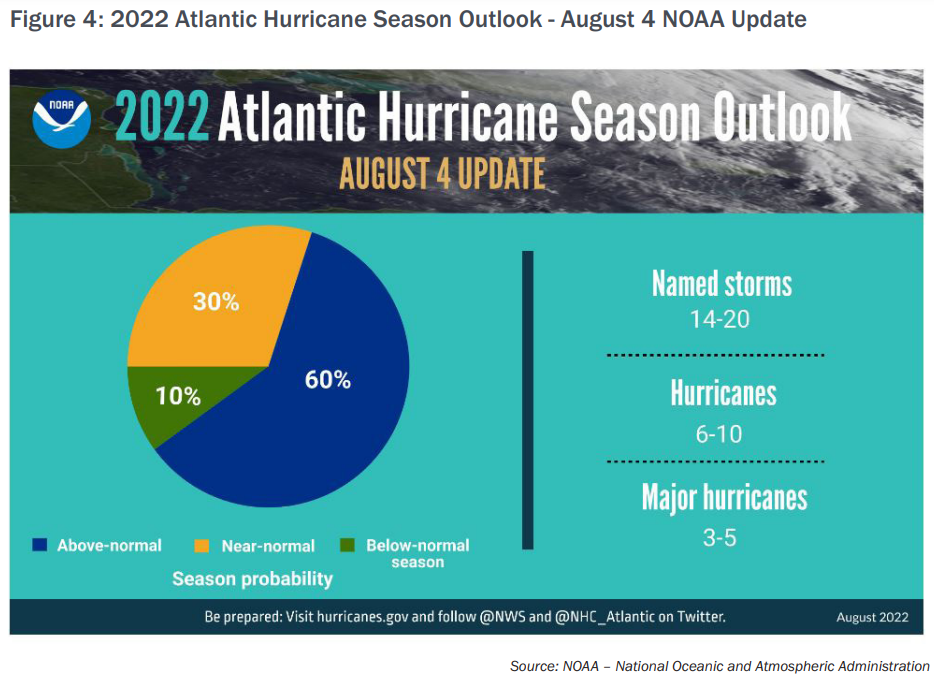

As we enter peak season for Atlantic hurricanes, three well-known Atlantic hurricane season forecasters predict this will be the 7th consecutive year of above average-activity, which is reflected in their mid-season updates to their predictions. The Colorado State University (CSU), Tropical Storm Risk (TSR) and NOAA, forecasted storm numbers seen in the chart on page 3 are higher than the 30-year average benchmark. See Figure 3.

Environmental factors cited for the enhanced activity include sea surface temperatures in the tropical North Atlantic and Caribbean remaining warmer than average, and the ENSO phase is expected to remain in La Nina conditions for the duration of the Atlantic Hurricane Season. The numbers in the table and chart include the three tropical storms from June and July, Alex, Bonnie, and Colin, none of which made landfall. Before reaching tropical cyclone status over the Atlantic, the unnamed storm system that would become Alex produced 11 inches of rain in the Miami area with local flooding. See Figures 3 and 4.

WILDFIRE SPOTLIGHT

The National Interagency Fire Center (NIFC) four-month outlook issued on September 1 forecasts above normal significant wildfire potential in much of the Northeast in September through November due to ongoing drought there. Most of Northern California and parts of the Pacific Northwest are forecast to have above normal potential in September, with most of those areas returning to normal in October. Much of the Southwest is forecast to have average potential, due to the North American Monsoon’s precipitation improving the drought situation there. Below normal precipitation and above normal wildfire potential is forecast to continue in Oklahoma and is forecast to expand to Texas by December. The US is approximately 116% above the ten-year average for acres burned, year-to-date through August. The NASA / Fire Information for Resource Management System US/Canada (FIRMS) maps illustrates the US active wildfires over 1,000 acres as of September 7, 2022. See Figure 5.

FLOODING SPOTLIGHT

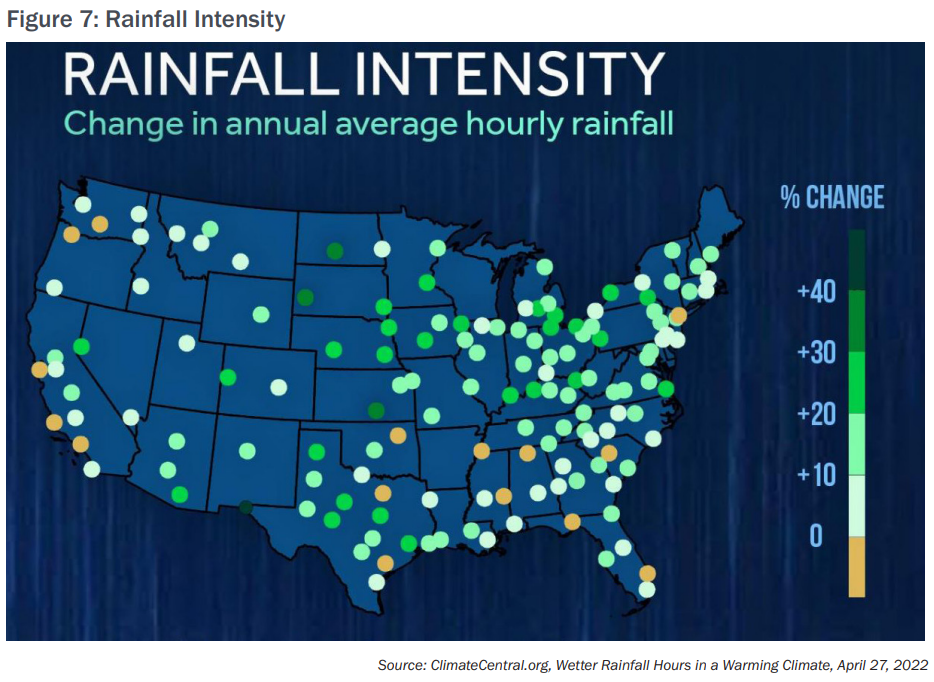

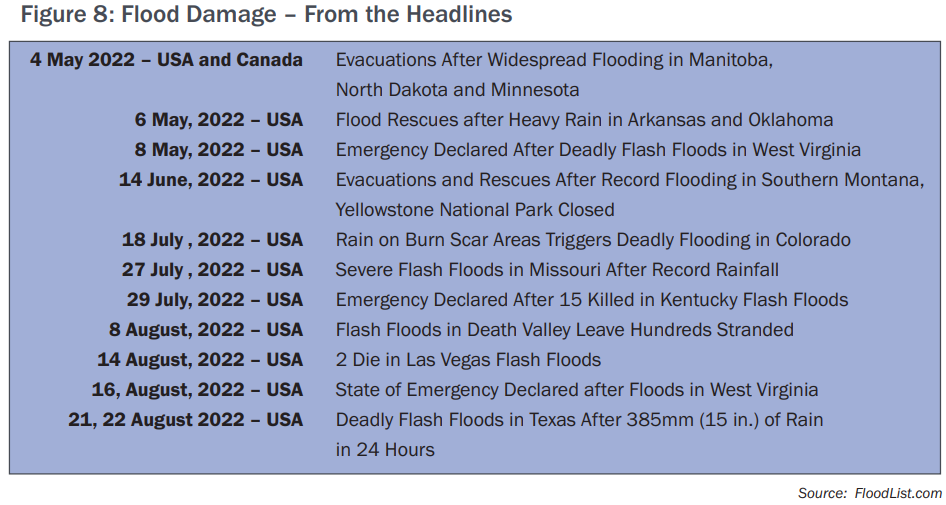

The Weather Channel – Meteorologist Ari Sarsalari explains “…warmer temperatures across the globe are causing more water to evaporate from the land and oceans. This increases the size and frequency of heavy precipitation—basically like we’re seeing across this area of Missouri.”

“A recent study by Climate Central revealed [up to] a forty-two percent increase in the heaviest precipitation events across the Midwest since the 1950s, so while climate change doesn’t directly cause individual floods, it is intensifying the factors that do.” See Figures 6, 7 and 8.

UPDATE – CHAMPLAIN TOWERS SOUTH – SURFSIDE, FLORIDA CONDO COLLAPSE

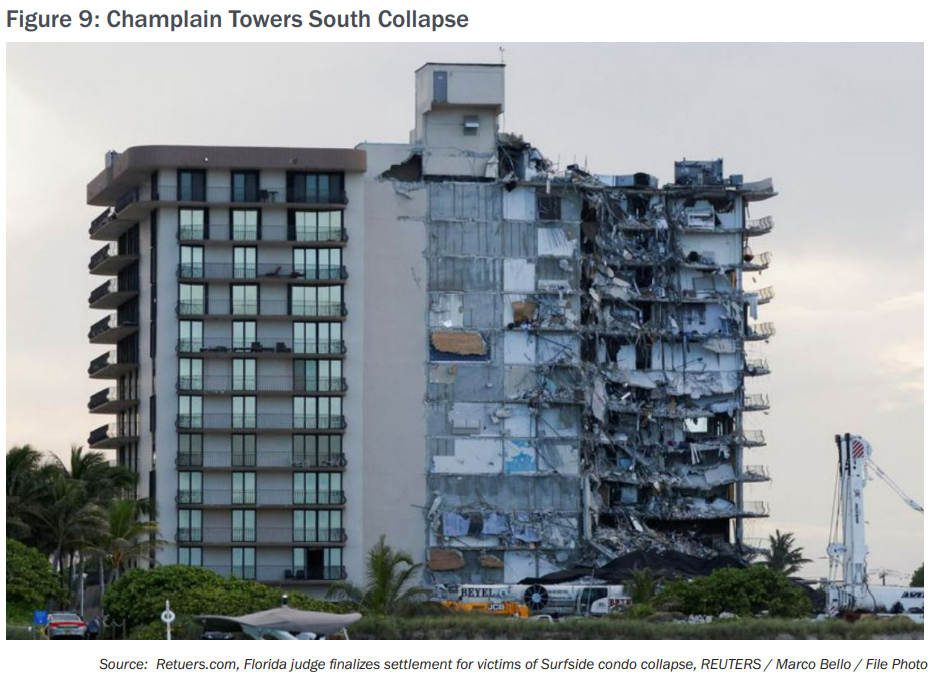

On June 24, 2021, the 12 story, 135-unit condominium built in 1981 known as Champlain Towers South in the Miami suburb of Surfside, Florida partially collapsed, killing 98 people. (See Figure 9.) Contributing factors to the collapse are believed to be construction of a new condo adjacent to Champlain Tower South and maintenance deficiencies at Champlain Towers South, including issues with the basement level parking garage which had been originally reported in 2018 but not approved for a $15 million remediation project until April of 2021. The main structural remediation work in the garage had not yet begun at the time of the collapse.

In response to the collapse, the State of Florida passed a new law requiring statewide recertification of condominiums more than 3 stories and requiring apartment owners to contribute to reserves, as well as making building inspection records available to tenants and prospective buyers, according to the Local 10.com May 25, 2022 report.

Reuters.com reported on June 23, 2022 that a judge finalized a $1+ billion settlement to be awarded to the survivors, families of the deceased and owners of damaged property. Earlier in 2022, a separate settlement for the condo owners was reached for $96 million. Both settlements will be mainly funded by payments from the insurance policies of the settling parties. Additional funds going toward the settlement will be from the recent sale of the land where Champlain Towers South stood to a Dubai developer who plans to build luxury residences on the site, as published by the Tampa Bay Times on May 25, 2022.

Per the Miami-Dade County Circuit Court, Case No: 2021-015089-CA-01, the $1+ billion settlement involved multiple settling parties, including the security firm for Champlain Towers South in the amount of $517.5 million, plus the general contractor for Eighty Seven Park and the condo being constructed adjacent, who settled for $157.0 million. The majority of the balance of the settlement involves various subcontractors of both Champlain Towers and the Eighty Seven Park condo project. However, additional parties listed in the settlement included the Town of Surfside and the legal counsel for the Champlain Towers Condo Association.

As CBSnews.com reported on May 25, 2022, federal investigators at the National Institute of Standards & Technology (NIST) are now continuing their investigation with invasive testing of the concrete and steel for density, porosity and corrosion from environmental climate change sea level rise and saltwater intrusion.

THE RT SPECIALTY PROPERTY COMMITMENT

“At the center of RT Specialty Property Team’s foundation is its renowned industry experience and ability to deliver customized and creative solutions. Through our hands-on leadership, RT Specialty commits to excellence with a continued investment in, and development of exceptional national talent. We provide access to a wide range of specialized expertise with a deep bench of talent, which is critical to achieving the best outcome for our clients,

especially during challenging and complex market cycles. Our team is a key asset for our retail broker trading partners, providing excellent solutions for the insured,” says Brenda (Ballard) Austenfeld, President and Managing Director of RT Specialty’s National Property Team.