Beginning in the fall of 2017 and throughout 2021, the commercial property insurance sector sustained multiple years with above average loss events, which included severe tropical storms, wildfires and other weather-driven losses. As a result, several major property insurers are now reassessing their approach toward capacity offerings, retentions and pricing for catastrophe (CAT) risk. In 2021, the move to reappraise traditional catastrophe property underwriting has been further accelerated with Winter Storm Uri in early February 2021, impacting Texas and surrounding states; Hurricane Ida, with a large destructive path from the Gulf of Mexico through northeastern states; along with the December 2021 tornado outbreak in the lower midwest region. It has also been our experience that insurers are reevaluating and placing more emphasis on risk modeling capabilities, with an emphasis on coastal tier one and tier two counties, convective storm regions and wildfire zones. The ongoing pandemic has also created more underwriting scrutiny and policy language changes, which further tighten policy loss triggers for virus-related property damage and business interruption coverage around supply chain disruptions. We expect that insurance-to-value will continue to be a key area of emphasis, with insurers closely evaluating and challenging submitted valuations, while establishing minimum thresholds for reporting and possibly imposing restrictive policy language to ensure adequate insurance to value is reported.

In addition to loss experience, another contributing factor driving rate firming in the property segment is the increased cost of building materials and labor. Since the start of the pandemic in early 2020, annual loss projections for both large catastrophe and attritional claims are being raised to absorb the impact of these increases in loss experience. The rising costs initially seemed to be primarily driven by the supply chain interruptions and are now being further impacted by higher general inflation on raw materials and wages. This has especially affected the industry segments that are heavily slanted with new construction and renovation activities.

MARKET IMPACT

The insurance industry generally remains financially well positioned, yet property insurers and reinsurers are closely evaluating their portfolios and repositioning from segments delivering significant losses, reexamining aggregate structures and protection for lower layers, and maintaining underwriting discipline. Most major insurers appear to be focused on reducing the impact natural catastrophe losses have on earnings volatility, as catastrophe property losses exceeded expectations yet again in 2021, as outlined in more detail herein. Even with these challenges, since 2018, the excess & surplus lines segment has continued to grow and expand, experiencing a surge in premium growth, representing year-over-year double-digit increases reaching a total of $65.9 billion at the end of 2020, according to AM Best. The latest figures available from the WSIA 2021 Surplus Lines Annual Report, noted surplus lines premium volume again increased 21.9% through Q2 of 2021.

Similar to our retail broker trading partners, most of the investments for insurers over recent years have been focused on both external and internal needs, such as new platforms for expanding geographic reach and upgrading internal efficiencies. Insurer merger and acquisition transactions in late 2021 and early 2022 occurred at a high level with what appears to be a heightened strategic focus on improving technology capabilities.

REINSURANCE

Reinsurance treaty property renewals for January 1, 2022 were completed with retrenchment being the key driver. With the high escalation of both frequency and severity of global catastrophe losses since 2017, the current reinsurance treaty renewals seem to reflect a considerably more cautious approach to capacity deployment affecting certain portfolios and regions with continued price firming.

In our experience, renewals for 2022 were largely negotiated and settled on a specific account basis, producing significant variances of results dependent upon loss experience and performance of the carrier portfolio.

Building on increases over the last 18 months, reinsurance pricing for the January 1, 2022 renewals is viewed at more meaningful levels compared to the very moderate increases that were delivered over years 2019, 2020 and 2021.

Related to property catastrophe risk, pricing and capacity deployment offerings by reinsurers have also put greater emphasis on experience in recent years, rather than benchmarks used previously that were driven by longer term historical trends. Starting with Q3 2021 through the start of 2022, increases in reinsurance treaty renewals seem to represent an additional contributing factor to the continuation of price firming in the property market.

In recent years, insurance linked securities (ILS) have provided significant support for collateralized reinsurance and aggregate retro capacity. ILS investors now represent a diminishing base because of increases in trapped capacity.

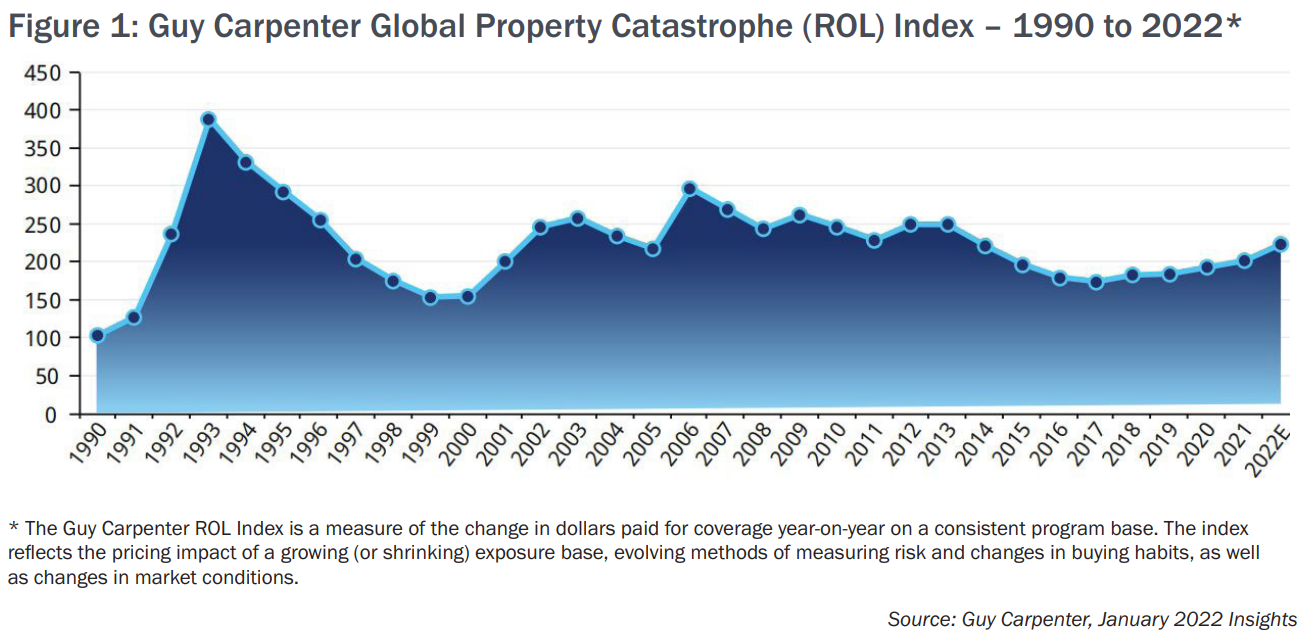

The Guy Carpenter graph above illustrates their global Catastrophe Rate-On-Line (ROL), and per Guy Carpenter findings, “This marks the biggest rise since 2006 and taking pricing back to 2014 levels.”

CATASTROPHE LOSSES

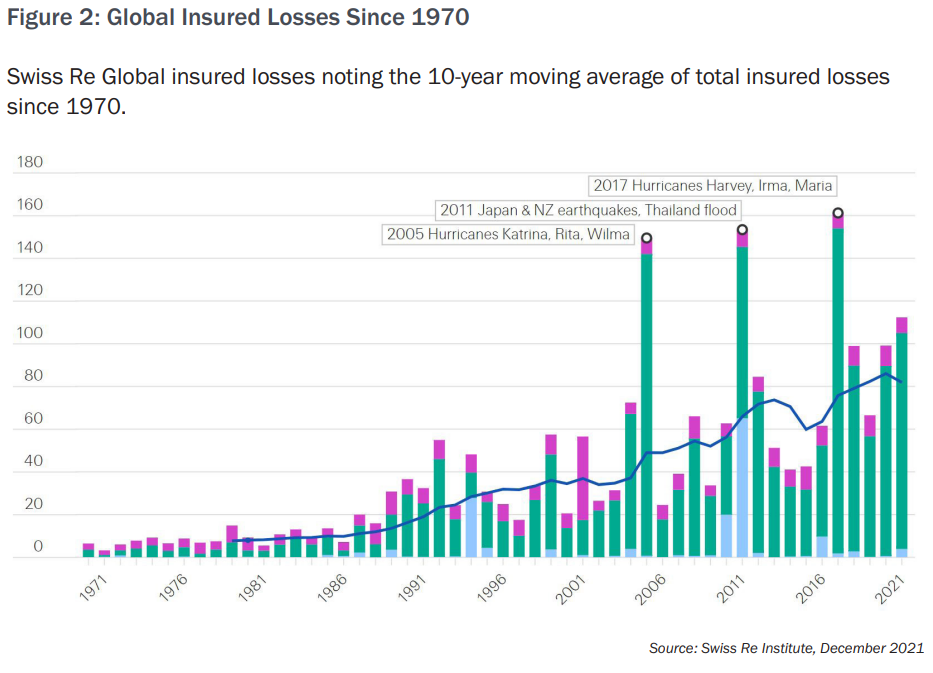

As previously stated, annual insured loss totals for catastrophe losses have continued to escalate over the past five years, where the “normal” benchmark is now considered to be $100 billion versus the previous estimate of $75 billion. In our view, this “new normal” of catastrophe losses continues to drive insurance companies to a more conservative approach in respect to the amount of catastrophe exposure they assume. See Figure 2 below.

Munich Re’s recently released Natural Catastrophe annual report for 2021 estimated “roughly $120 billion of the $280 billion of global losses caused by natural disaster were insured.” When compared to 2020, the twenty-one named Atlantic tropical cyclones of 2021 were again significantly above the long-term average of fourteen such storms for the period of 1991 through 2020. Overall, catastrophic losses for 2021 are 34% above the average compared to the past decade. Munich Re further noted, “Alongside 2005 and 2011, the year 2021 proved to be the second-costliest ever for the insurance sector (record year 2017: US$ 146 billion, inflation-adjusted)—overall losses from natural disasters were the fourth-highest to date (recorded year 2011: US$ 355 billion).”

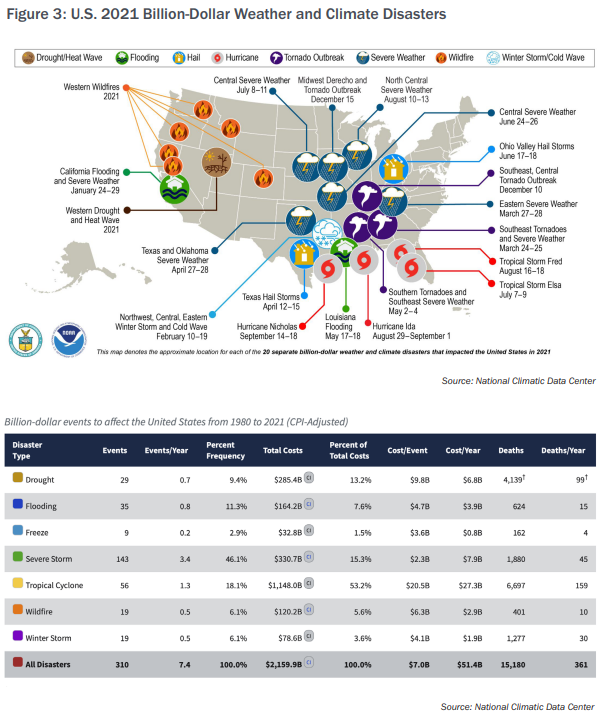

Munich Re’s annual report further stated, “The U.S. saw the largest share of natural disaster losses in 2021, approximately $145 billion, of roughly $85 billion were insured.” According to that same report, current overall loss estimates for Hurricane Ida (Category 4), which made landfall in Louisiana and travelled north through the northeastern states, has reached $65 billion, with $36 billion insured.

Other significant U.S. events for weather-related losses in 2021 include the February Winter Storm Uri in Texas and December convective storms, which included dozens of tornadoes with wind speeds up to 190 mph across several central and southeastern states. According to Munich Re’s January 2022 article, “Hurricanes, cold waves, tornadoes: Weather disasters in USA dominate natural disaster losses in 2021,” estimates for Uri have reached $30 billion with an estimated $15 billion insured. In an artemis.bm January 2022 article, Munich Re noted that the December convective storms are currently reported at $5.2 billion, of which $4 billion is estimated to be insured.

These events demonstrate the potential disparity between total economic losses versus insured losses for catastrophic disasters.

Following is the quarterly update to NOAA 2021 Billion-Dollar Weather and Climate Disasters dated January 14, 2022, which indicates 20 separate billion-dollar weather and climate disasters that impacted the United States in 2021. Please note these amounts are dollar estimates and are not shown as insured loss amounts. See Figure 3.

The high impact of events from secondary model perils such as winter storms and wildfires, in our experience, are causing insurers and reinsurers to place substantial weight on recent catastrophe loss experience in addition to analyzing longer term loss averages and use of modeled output.

WILDFIRE

The 2021 wildfire season experienced an early start with drought conditions driven by historically low rainfall coupled with low reservoir levels.

In the northern regions of California alone, multiple wildfires, including the Dixie, McFarland, and Caldor wildfires, were all raging by August 2021, as reported by the California Department of Forestry and Fire Protection. The overall severity of wildfires affected several other western states, including Utah, Arizona, Nevada, New Mexico, Oregon, Montana, and Colorado. In total, for 2021, wildfires across the U.S. burned close to 7.7million acres.

Historically, wildfires are most concentrated to a four-month summer-to-autumn period. Blazes in Montana and Colorado extended into December 2021. The Marshall fire in Colorado, fueled by an intense downslope wind with reported gusts of 115 mph, spread to approximately 6,000 acres and damaged more than 1,000 structures. The latest reports by Karen Clark & Company are projecting insured losses for the Marshall wildfire to reach $1 billion.

Wildfire concerns are expanding outside of the traditional western states, as the National Interagency Fire Center (NIFC) currently projects “higher than average” risk of wildfire potential through April 2022 for the Carolinas, Georgia, and Florida, along with central and southern plain states.

We expect that wildfire activity in later 2022 will remain a significant concern, with the expanded drought conditions continuing in several western states.

MARKET SPOTLIGHT

FLORIDA CONDO MARKET

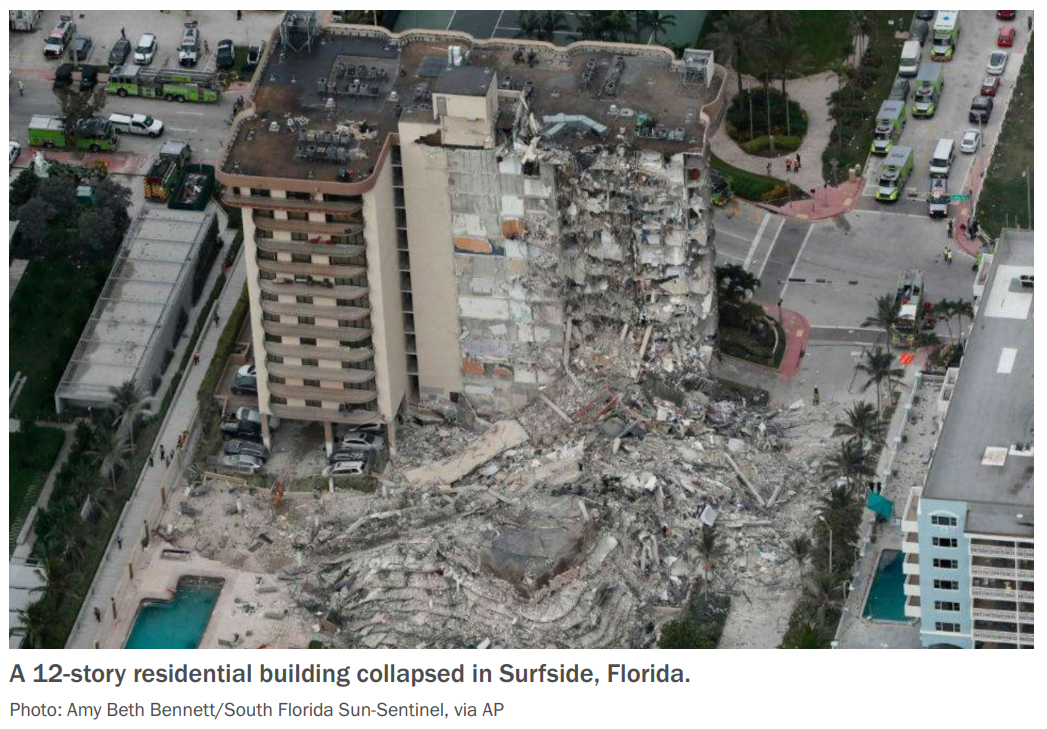

We have seen that the Florida condo market continues to be volatile with ongoing capacity reduction due to various insurers completely pulling out of this segment. It has been our experience that the remaining markets are increasing named storm percentage deductibles, scrutinizing valuations, and requiring scheduled limits while no longer offering blanket coverage. Additional areas of concern include inflation driving claim amounts, climate change, and age and quality of construction, particularly after the Surfside, Florida condominium collapse in June 2021.

In October 2021, following the Surfside, Florida collapse, Citizens Property Insurance Corporation, which provides windstorm and general property insurance for homeowners who could not obtain insurance elsewhere, announced it would drastically increase the number of inspections for policyholders from 5,200 in 2020 to more than 350,000 by 2025.

Litigation costs are also contributing to the property insurance market crisis in Florida. A recent Insurance Journal article detailed a report presented to Florida legislators by Guy Fraker of Cre8tfutures, LLC, a 30-year insurance industry consulting firm. This report stated that in 2019, Florida insurers paid almost $3 billion in lawsuit costs which translated into higher premiums for insureds. The report further stated claims unrelated to catastrophe losses account for approximately 60% of all litigation.

RT Specialty continues to appraise the situation to best assist our retail broker trading partners in navigating this challenging segment.

INDUSTRY SPOTLIGHT

BUILDER’S RISK

While the construction sector was deemed “essential” throughout the pandemic, construction and renovation-related activities have been seriously impacted by the variant viral surges, labor shortages and global supply chain interruptions. These factors, along with increases in the cost of lumber and other materials have, in our view, caused several challenges, including the need for policy term extensions on active projects, along with delays in commencement of project construction. Lumber prices have recently begun to normalize, which will accelerate the wood frame segment as we move forward. Overall, the construction outlook is expected to be very active.

As we begin 2022, the U.S. Census reports four consecutive months of an increased building permit count for housing units, including single-family and multifamily. RT Specialty brokers have seen an influx of growth, as well. Meanwhile, market capacity for wood frame construction remains incredibly limited; property insurance rates and deductibles have continued to rise. Increased deductibles for water damage is a key area of focus to help insurers combat attritional losses, which have become a major driver for carrier loss ratios in this segment. To further improve underwriting results, we have seen that builder’s risk insurance carriers have increased their underwriting requirements, such as requiring implementation of perimeter security measures while meeting stringent loss control and protocols for hot works.

In our experience, the timing of implementation of a bind order to commence builder’s risk coverage has also become more restrictive. Insurers have become less lenient and require date-of-policy inception for a project to be closer to the initial start of construction activities versus the start of foundation work and vertical construction. There is resistance from some insurers for policy term extensions, especially with coastal frame projects, if this requires coverage to continue into the following hurricane season. Many builder’s risk insurers are limited to a policy term length of 36 months; therefore, the program structure could consist of phases or have break / review clauses.

Renovations within the construction arena have become more challenging where coverage for the existing structure is required, particularly for frame construction. Older historical buildings within urban areas can also be challenging due to insurance-to-value and tax credits, among other concerns by the underwriting community. Engineering data is crucial to provide in order to shine the best light as exposures are reviewed.

We anticipate that the Infrastructure Investment and Jobs Act passed in late 2021 will have a large impact on all aspects of the American construction sector. Much needed improvements of roads, bridges, travel hubs and power infrastructure are on the horizon to break ground imminently. U.S. and European insurance markets appear eager to diversify their portfolios with these projects, while many insurers will likely require coverage for catastrophe. Gathering and preparing extensive construction and risk control data including wildfire mitigation plans, where applicable, at the time of the submission will be essential to achieve best results.

Despite these challenges, the builder’s risk professionals within the RT Property Team remain eager and ready to provide creative and specialized solutions for our retail broker trading partners and their insureds within this segment.

COVERAGE SPOTLIGHT

CRYPTOCURRENCY OPERATIONS

The increasing popularity of cryptocurrency (crypto), defined as a digital medium of monetary exchange that is encrypted and decentralized, is allowing opportunities for some insurance carriers within this market segment. While insurance for theft and cyber-fraud losses of crypto itself is still extremely limited, RT Specialty is seeing an increase in submissions seeking coverage for the physical assets of those involved in the mining operations of crypto, also known as Bitcoin farms.

With the U.S. regulatory environment still evolving as it relates to cryptocurrency, we have seen that many pension funds and sovereign wealth funds are buying shares or investing in publicly or privately-held mining operations. These operations typically have signed agreements relating to clean energy with their local communities, per Forbes, as it is estimated that 0.21% of all the world’s electricity goes to powering Bitcoin farms.

Property insurance carriers are responding to this specialized segment by offering coverage in various types of structured property placements. Along with business interruption, extending coverage to include equipment breakdown for crypto mining hardware and the electronic data processing exposure can be challenging. In several cases, the use of monoline solutions is required while structuring proper coverage.

The RT Property team has successfully placed several of the largest publicly traded crypto mining operations in the country and look forward to leading the charge on this emerging market segment.

THE RT PROPERTY COMMITMENT

“RT Specialty combines renowned industry experience and advanced technology as our foundation to deliver focused and creative solutions. Through our hands-on leadership, RT Specialty has a commitment to excellence with continued investment and development of exceptional talent. We provide access to a wide range of specialized expertise, which is critical during challenging and complex market cycles. Our team is a key asset for our retail broker trading partners as they provide the topnotch solutions for the Insured.

The RT Property Team continues to shine with our motto - ‘Out Think. Out Work. Out Execute. Repeat!’” says Brenda (Ballard) Austenfeld, President and Managing Director of RT Specialty’s National Property Team.