Market Overview

As we move into the last quarter of 2021, the overall commercial insurance market continues a tightening trend with year-over-year price increases on most casualty lines. Over the last two years, an environment with higher rates has attracted new entrants and additional capital to the marketplace. As a result, there is less volatility and more predictability as we move forward in this year’s renewal cycle. Depending on the quality of the risk and within certain industry sectors, the market remains very selective with underwriters looking to achieve overall profitability while putting less emphasis on their top line premium goals.

With the tight casualty market existing over the past two renewal cycles, underwriters are now closer to reaching their target rate levels and attachment points but remain cautious on their capacity and limit deployment. Policy terms and conditions continue to be modified, driven primarily towards tightening language to eliminate any liability exposure to communicable disease. As mentioned in prior reports, with the COVID-19–related losses being slow to emerge, there is a relatively unknown financial impact over the long-term for the insurers and the reinsurance market. Although the potential of future development of pandemic claims remains a contributing factor, the continued upward trends in attritional losses, nuclear verdicts, higher frequency of punitive awards and liberal class action certifications remain the main drivers guiding the increases in premium levels.

Rate levels on recent renewals have continued to rise across most industry sectors in casualty lines. Pricing for primary general liability is moving closer to a range of flat-to-single-digit increases but can still vary significantly depending on the account size and industry segment.

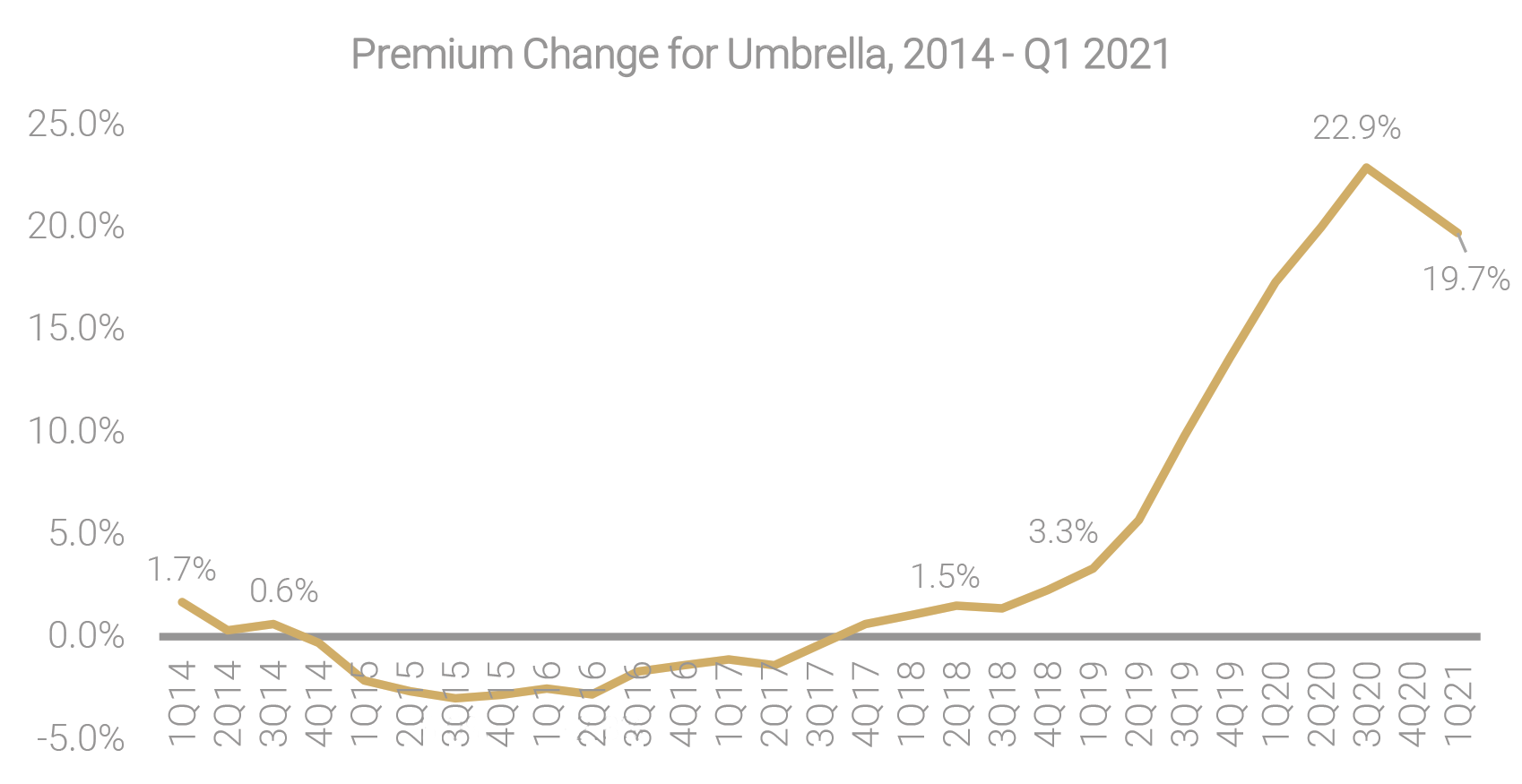

Pricing on lead umbrella and excess liability renewals remain on a much higher percentage increase level, although the significant increases over the past two renewal cycles are beginning to moderate and starting to show a slower rise year-over-year. The individual carrier limit offerings are now typically $5 million or less for lead umbrella and excess layers compared to the $10 and up to $25 million blocks that were available from a single carrier in past years.

Source: The Council of Insurance Agents & Brokers, Q1 P/C Market Survey 2021

Source: The Council of Insurance Agents & Brokers, Q1 P/C Market Survey 2021

Refer to the graph above, issued from the most recent CIAB P/C market report for umbrella pricing by quarter (1Q 2014 through 1Q 2021). This graph demonstrates a sustained price climb, starting from the later quarters of 2017 through the first quarter of 2021. Umbrella coverage continues to show, on average, the most significant premium increases of all the standard commercial insurance lines, but those increases are beginning to show some moderation, falling to 19.7% in Q1 2021 from 21.3% in Q4 2020.

Overall, business auto rate increases have generally been reported in the high single-digit to mid-teens range over the last quarter. This excludes certain insureds specific to the transportation industry segment where loss severity has been steadily increasing, driven by the high proportion of litigated claims and with nuclear verdicts that continue to rise.

Workers’ compensation, in addition to the excess workers’ compensation market, has been one of the more profitable lines for carriers over recent years, with renewal pricing staying within single-digit increases or remaining generally flat. Over the past year and through the height of the pandemic, workforce claims associated with vehicle accidents were reduced. Now that reopening has started in several regions, carriers are keeping a close watch on developments around state statutes and presumption legislation, in addition to reevaluating policy language by limiting or excluding avenues for communicable disease-related claims. Going forward, with the emphasis on remote working expected to continue in many industry sectors of the workforce, there is a renewed focus towards increases in ergonomic-type injuries. A positive development coming out of the COVID-19 pandemic has been the increased utilization of telehealth, which provides cost-efficient access to medical care and reduces

lost time from work.

Market Drivers

The improved casualty insurance pricing has brought new capacity to the market over the last year. This new capital is being supported by both new entrants and the return of more traditional market sources and market capacity from London and Bermuda. This added capital is getting strong support from the private equity market and the upward surge of special purpose acquisition companies (SPAC), which are facilitating several of the new company entries in both the direct and reinsurance segments. Several of the new start-up facilities that started to appear in the last quarter of 2020 are beginning to have a material impact on the market, having completed their initial investment phase and establishing their underwriting operations. Where there have been pockets of diminished capacity and volatility in pricing, the new participants are beginning to bring in added capacity to fill the voids and help reduce the instability in pricing. As we move into the last quarter of 2021 and forward into 2022 with more capacity entering the market, we expect to see this trend towards stabilization continue.

There are other developing factors that will potentially alter the casualty marketplace. Several of the lead casualty carriers are reevaluating their pricing tools to better address the increased claim frequency and severity of their portfolios, along with their reserve adequacies. This includes a trend towards excess liability carriers proposing higher minimum premiums, especially on the higher excess layers where exceptionally low minimums prevailed for several years in the softer market. Lead umbrella carriers are continuing to demand higher attachment points. As a result, the limits on the primary coverages need to be stretched higher or excess buffer markets are required to be put in place resulting in additional cost. The inadequacy of pricing excess liability over the years has driven several of the carriers to challenge their historical methods and positions in the marketplace. More carriers that traditionally only offered lead umbrella and excess capacity are now leveraging themselves to also obtain positions on the primary casualty lines. The recent Willis Tower Watson’s Insurance Marketplace Realities 2021 Spring Update noted that since Q2 2020, there has been a “15% increase in the number of buyers purchasing supported casualty programs (i.e., primary programs with umbrella / excess from the same insurer) and that trend is accelerating.” With the long-term increase in loss cost and the continuation of higher nuclear jury verdicts from the effects of social inflation coupled with rising reinsurance cost, the expectation is that these adjustments in the casualty marketplace will take on more permanency and maintain a great degree of underwriting discipline by the carriers. More specific to the larger casualty programs and accounts, these carrier adjustments have created changes with their insureds, restructuring their programs and taking on higher retentions. The casualty programs in the larger account segment have been more negatively impacted by the increased pricing and capacity restrictions versus the more muted increases seen in the small commercial segment over the past two renewal cycles.

Market Spotlight: Transportation

As casualty market conditions continue to tighten, certain industry segments are impacted more heavily than others, particularly affecting commercial transportation. The increase in frequency and severity of losses for commercial trucking and accounts with large fleet exposures has been driven by several factors. The culmination of increased accidents due to distracted drivers, rising medical expenses, commercial truck driver shortages and more vehicles on the road covering more miles have all contributed to market tightening. The high cost to obtain the limited available excess liability capacity has resulted in the industry’s increased development and use of risk control technology / telematics as a primary focus, in place of using excess insurance to manage their CAT liability risk. With the market offerings being extremely limited, recent excess liability renewals for motor truck carriers have resulted in some firms that traditionally placed high limit towers deciding to amend their casualty program structure and lower the amount of excess limits they purchase while increasing their retentions.

Reinsurance

Looking back at the January 1 treaty and ongoing reinsurance treaty renewals, pricing outcomes have been relatively modest, except for cedent insurance carriers with successive years of losses. These carriers’ reinsurance treaties resulted in much more significant increases in rates. Policy wordings regarding the pandemic-related exclusions continue to be a primary focus with ongoing treaty renewal negotiations, but overall, reinsurance terms relating to communicable disease resulted in little change for most casualty insurance lines, except for workers’ compensation.

Casualty reinsurance pricing is connected to several of the same factors affecting the direct casualty lines. The most significant factors include social inflation driven by the aggressive and active plaintiff’s bar and rising nuclear verdicts, adverse loss development, reserve inadequacy and the future uncertainty that remains regarding the long-term impact of COVID-19.

Strong capitalization continues to support the reinsurance market. Dedicated reinsurance capital increased in 2020 to $416 billion. Similar to the direct casualty market startups, the private equity market and the special purpose acquisition companies (SPAC) are facilitating a significant amount of the new capital entering the reinsurance market.

Looking Forward

The overall commercial insurance market is showing signs of stabilization. Established carriers are beginning to further expand their available capacity while drawing in new capital to fill in the voids and create more competition. In contrast with past cycles, the continuation of tightening conditions does not reflect the same underlying issues of past hard markets. Most carrier balance sheets remain strong and supported by a steady flow of reinsurance capital. The current pricing and capacity restrictions are driven more by individual carrier appetites as they attempt to set adequate rate levels. The under-performing risks are the most impacted, as underwriters rigorously evaluate the preferred business over the poor-performing accounts. As we move into the last quarter of 2021, the casualty insurance market will remain challenged, and in response, insureds need to differentiate their risk profiles and use the latest analytical tools to optimize their program structure.

RT Casualty Recommendation

The RT Casualty team has been built with the necessary expertise and teamwork to fully assist its retail brokers in the preparation for renewals and new business negotiations. We understand each account is unique and has different risk characteristics. As your wholesale risk trading partner, RT Casualty recommends starting the renewal planning process early. This advanced planning allows us adequate time to properly deploy our expertise and best differentiate the insureds risk profile for presentation to the casualty markets. The result is a competitive buying strategy with a high-quality market submission to best enable an insured to receive and evaluate all viable renewal options. Throughout the process, RT Casualty maintains close coordination with our retail brokers to maximize direct communication with the insureds and markets.

RT Casualty is a part of RT Specialty. RT Specialty is a division of RSG Specialty, LLC, a Delaware limited liability company based in Illinois. RSG Specialty, LLC, is a subsidiary of Ryan Specialty Group, LLC (RSG). RT Specialty provides wholesale insurance brokerage and other services to agents and brokers. As a wholesale broker, RT Casualty does not solicit insurance from the public. Some products may only be available in certain states, and some products may only be available from surplus lines insurers. In California: RSG Specialty Insurance Services, LLC (License # 0G97516). ©2021 Ryan Specialty Group, LLC.

This Article is provided for general information purposes only and represents RT Specialty’s opinion and observations on the current outlook of the US Casualty Insurance market and does not constitute professional advice. No warranties, promises, and/or representations of any kind, express or implied, are given as to the accuracy, completeness, or timeliness of the information provided in this Article. No user should act on the basis of any material contained herein without obtaining professional advice specific to their situation.