Market Overview

Through the first two-thirds of 2021, several segments of the commercial property and casualty market remain challenging. Pricing is largely dependent upon the insured’s specific risk exposures, protection features and loss history. Risks with less desirable characteristics and experience are still encountering high annual rate increases. Overall, carriers have become more selective and emphasize underwriting profitability in order to obtain premium targets.

In a report published by Marsh, commercial insurance prices increased globally on an average of 18% in Q1 2021. This represents the 14th consecutive quarter of price increases, yet the first to show a slight change in the average percentage rate of increase since Q4 2017. Refer below to Figure 1, the Marsh Index - US Property chart.

.png?width=1462&name=RT%20Property%20Outlook_June%202021_Marsh%20Graph_062421%20(002).png)

Source: Marsh Global Analytics, Insights | February 2021

While the overall property market may show a slight decrease in rate, specialized and very specific areas continue to have rate increases. The loss activity throughout the property segment into 2021 Q3 and Q4 could potentially have an impact on this trend.

Property market changes escalated by the pandemic and subsequent economic downturn have fueled more underwriting scrutiny with higher emphasis on specific exposures, such as supply chain vulnerability. Since late 2017, a continuation of significant weather-borne catastrophic events, increased reinsurance costs, and low-interest rates decreasing insurer investment income remain important factors that have negatively impacted the commercial property insurance market.

Market Impact

In combination with pressure on renewal pricing, there continues to be a strategic deployment of insurance capacity. Over the past two renewal cycles, some accounts required transitioning from single or large limit lead carrier placements to shared and layered structures, which is one of the drivers of the increased costs of renewal programs. Recently, there has been an increase in new carrier entrants and start-up underwriting ventures, along with more available capacity from existing players attracted by higher rates. Even before 2021, a report issued by Aon noted: “$20 billion of new capital entered the market globally between March and December 2020.”

Higher retentions have also been on a steady increase. As a result, discussions for alternative risk retentions, parametric products, financing strategies, and captive utilization have become increasingly popular. Scrutinizing terms and conditions also remain an area of focus for underwriters. These can include reducing or eliminating certain coverages, such as riot and civil commotion. In addition, throughout the last renewal cycle, more restrictive policy language is now commonplace for communicable disease, fungus and bacteria-related exposures.

With the continued roll out of the COVID-19 vaccine, improving economic conditions need to be monitored, and the total impact of insured losses remains uncertain. Loss estimates related to COVID-19 have been in the $80 billion range with variable factors. Most of the coverage litigation focuses on business interruption losses related to manufacturing, retail, hospitality and entertainment industries.

Catastrophe Losses

The year 2020 set a record with nineteen events exceeding $1 billion in losses in the U.S. alone. Seventeen of these events occurred in the first three quarters due to a significant surge in hurricanes, wildfires, and other extreme weather events. In addition, Aon’s Outlook Market report issued in January 2021 reported, “U.S. insured catastrophe losses landed at $66 billion in 2020, significantly higher than usual compared to the previous 10-year average of $46 billion.”

The Atlantic Hurricane Season so far has fourteen named storms including six hurricanes and two major hurricanes. Eight of the fourteen made US state landfall. As of this writing, major Hurricane Ida’s catastrophic effects are complex and being evaluated, and it is too soon to describe its effect on the insurance market. The NOAA forecast dated August 4, continues to project season activity will likely be more than the thirty-year average activity. Some factors cited are ENSO in Neutral Phase which may transition to weaken La Nina, reduced vertical wind shear, and an enhanced Africa monsoon. An average hurricane season typically produces fourteen named storms, seven hurricanes and three major hurricanes.

The intense drought and above normal heat in combination with other adverse conditions create the setting for above average wildfire activity in the Northwest. The Dixie Fire in Northern California exceeded 900,000 acres. It is the second largest wildfire in California in the years 1932-2021 as tracked by CalFire. The February 2021 Winter Storm, with extreme cold, snow and ice, impacted Texas and the Southern U.S. before moving to the Midwest and Northeast regions. Total damage estimates have been set at $195 billion. Insurance Journal has reported insured losses in Texas alone in the $10 billion to $20 billion range, with a strong potential of reaching the higher end of this range due to residential and commercial risks affected by prolonged power outages, demand surge and resultant mold damage claims.

Reinsurance

The January 2021 reinsurance treaty renewals reflected the overall firming market with moderate price increases for U.S. property and casualty lines. The uncertainty of COVID-19 claims and the 2020 natural catastrophe losses were the primary drivers. Although there has been some deceleration in 2021 primary lines reinsurance rate increases, difficult renewals will persist in this current market. This challenge will keep reinsurance pricing for remaining treaty renewals on the firm side through 2021.

Even with obtaining price increases for reinsurance capital, several larger-capacity reinsurers have scaled back or withdrawn from under–performing lines of business with insurance carrier clients. Reduced reinsurance capacity directly impacts the primary carrier’s retention of risk and lowers policy limit offerings. Another significant focus with recent renewal treaty negotiations has been policy contract wording, emphasizing pandemic-related exclusions.

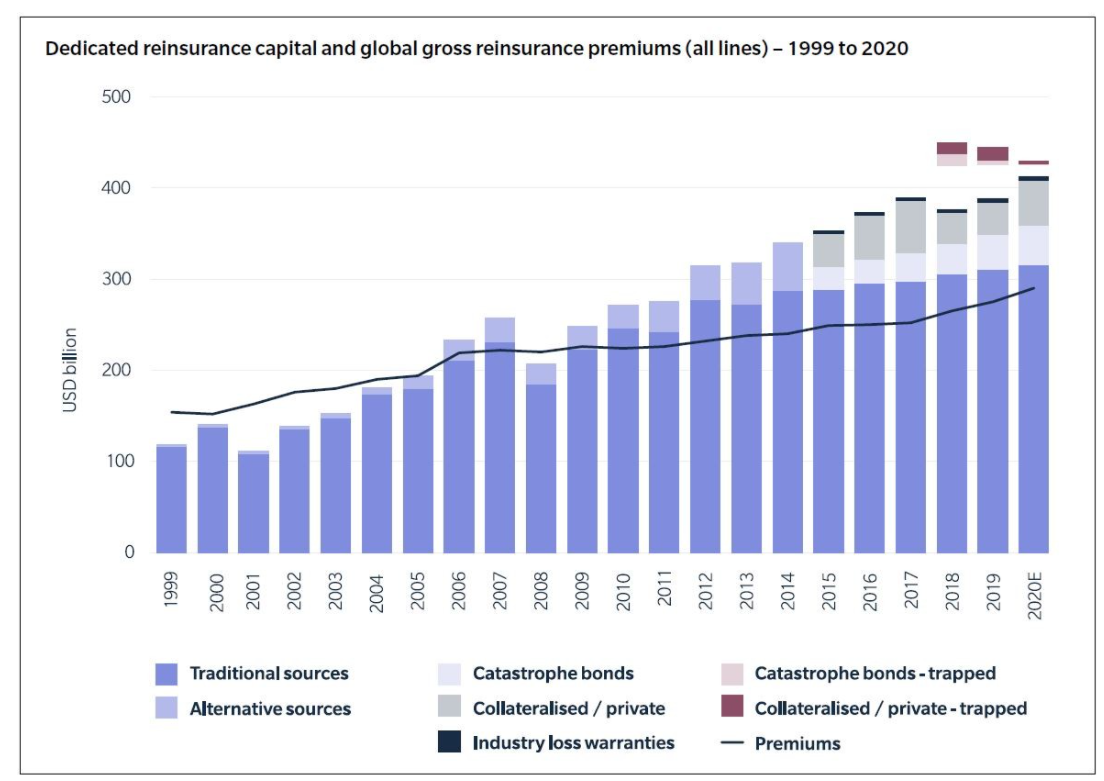

Source: Guy Carpenter, Reinsurance Renewals at 1/1: Continued (slow) Improvement, guycarp.com

Refer to Figure 2, the Guy Carpenter chart showing dedicated reinsurance capital and global reinsurance premiums (all lines) –1999 to 2020. Both traditional and alternative capital premiums overall increased slightly year over year. This is despite the pandemic’s loss development and a highly active loss year for natural catastrophes. The reinsurance market continues to be well-positioned to supply capacity with the current level of capital. The Guy Carpenter report noted capital injections exceeding $20 billion and the recovery of the financial markets have helped stabilize reinsurance capacity.

Additional new capital entered the reinsurance market in 2021. It is still well positioned to meet the overall demand levels with reduced deployment on underperforming business lines with mid-year treaty renewals.

London and Bermuda Insurance Markets

In terms of insurance and reinsurance capacity over the last two years, both London and Bermuda markets have selectively increased participation and appetite for North American specialty property risks. This increase has been primarily driven by higher pricing and achieving positive rate momentum as the market continues under tightening conditions. Other factors fueling this expansion include:

- Improving underwriting market terms and conditions

- Having strong capital and solvency positions

- Competing for significant investments that improve operating efficiencies

Both London and Bermuda have increased premium writings in 2021. Several London syndicates and carriers are offering increased capacity year-over-year on renewals, for both primary and excess layered structures. The Bermuda market has made a substantial effort to deploy more capacity towards North American property risks over the past few years. This capacity expansion has come through increased capital from existing Bermuda-based facilities along with new start-up facilities supporting both direct and reinsurance placements.

Market Spotlight: Real Estate / Habitational

Since tightening market conditions began in the fall of 2017, multifamily habitational insurance programs have experienced significant adjustments to address the challenges for underwriting this class of business. Several traditional carriers that historically supported this class have cut back capacity or withdrew from habitational risks entirely.

The Florida condo business was particularly hard hit with the recent court-ordered liquidation of AmCap, along with carrier exits and capacity reductions. While capacity remains available with Citizens, open market placements continue to be a cost-effective approach, even with the 15% to 30%+ rate increases that the compressed marketplace is demanding.

This has been driven partly by the overall firming of the property insurance market and further impacted by increased frequency and severity of attritional losses in recent years. In addition, several larger programs contain catastrophe-exposed properties located in coastal regions and in mid-central states susceptible to losses from Atlantic storms and convective storms.

Product Spotlight: Epidemic / Pandemic Response Product

RT Specialty has been selected as a key trading partner of a stand-alone epidemic/ pandemic response product. Triggered by a catastrophic viral disease outbreak, disrupted business interruption loss is covered if caused by the viral outbreak. The product can be individually adapted to fi t an insured’s exposure, covering outbreaks of both unknown and known diseases and including three different trigger options that, depending on risk profile and indemnity, can be tailored to cover gross profits / earnings,

fixed costs, debt obligations, extra expense, increased costs of work, employee benefits, life, contingent business interruption or a combination thereof. Target industries include retail, hospitality & tourism, manufacturing, construction, infrastructure & mining and real estate. Note – this product is only available for new disease outbreaks. COVID-19 and its variants are excluded.

Coverage Spotlight: Cyber Risk

Recent headlines prove no industry is safe from cyber attacks, including the insurance industry. A report published by AM Best states cyber attacks reached new heights in 2020, in part due to COVID-19 necessitating the need for a corporate response to widespread employee remote access. “Alert hackers and cyber criminals pounced on any systemic vulnerabilities in software, making 2020 the year of ransomware,” the report said. “The trend has worsened thus far in 2021, as exemplified by the attacks on SolarWinds, Microsoft Exchange, Colonial Pipeline, and many more.” As property insurers continue to further restrict or remove cyber-related coverage, stand-alone cyber policies are becoming more prevalent. Assessing cyber risk and committing resources to protect your organization—including cyber insurance—is worth evaluating for both retailers and their insureds in 2021.

Source: AM Best: Insurers must review cyber risks 'urgently,' June 3, 2021, AM Best Data and Research

RT Property is a part of RT Specialty. RT Specialty is a division of RSG Specialty, LLC, a Delaware limited liability company based in Illinois. RSG Specialty, LLC, is a subsidiary of Ryan Specialty Group, LLC (RSG). RT Specialty provides wholesale insurance brokerage and other services to agents and brokers. As a wholesale broker, RT Specialty does not solicit insurance from the public. Some products may only be available in certain states, and some products may only be available from surplus lines insurers. In California: RSG Specialty Insurance Services, LLC (License # 0G97516). ©2021 Ryan Specialty Group, LLC.

This Article is provided for general information purposes only and represents RT Specialty’s opinion and observations on the current outlook of the US Property Insurance market and does not constitute professional advice. No warranties, promises, and/or representations of any kind, express or implied, are given as to the accuracy, completeness, or timeliness of the information provided in this Article. No user should act on the basis of any material contained herein without obtaining professional advice specific to their situation.