A business’s experience modification factor (E-Mod) directly impacts the premium they are charged for their workers’ compensation coverage. Insureds often inquire about this important rating factor when reviewing a WC quote.

WHAT IS AN EXPERIENCE MODIFICATION?

An experience modification factor (known as an E-Mod, experience mod, ex mod, emod, mod, etc.) is a rating factor calculated using an individual insured or combinable group of insureds’ loss experience over a period of time as it correlates to the expected loss values for the industry or classification.

WHY IS AN EXPERIENCE MODIFICATION IMPORTANT?

Simply put, a business’s experience modification factor directly impacts the premium they are charged for their workers’ compensation coverage. When pricing the account, underwriters will start with the manual base rate for the class code as filed to the state department of insurance. Before they even review for specific account characteristics, the E-Mod is applied to the account.

Additionally, an insured’s E-Mod affects their workers’ compensation market options. Some insurance companies have a maximum and minimum E-Mod they can write as specified in their underwriting guidelines. Other carriers specify a higher rated paper for accounts with a history of debit mods.

An unfavorable E-Mod may also affect a business’s ability to get contracts. Government agencies or general contractors, for example, may only contract with businesses who have an E-Mod under 1.40. In this example, any company with an E-Mod over this threshold would not be considered for the contract.

DO ALL INSUREDS HAVE AN EXPERIENCE MODIFICATION?

No. States determine certain criteria an insured must meet prior to becoming eligible for an experience modification. Since an E-Mod is determined based on prior loss history, new ventures or accounts with less than a certain number of years of prior coverage (typically 2-3) will not have an experience modification. Similarly, risks below a certain premium size will not qualify for an E-Mod. Premium threshold varies by state and the minimum premium for an E-Mod can range from $3,000-$20,000 or more. The acronym DNQ is commonly used to identify a risk that "does not qualify" for an experience modification for one reason or another. Alternatively, the term “unity factor” may be used which means a risk has an E-Mod of 1.00 (no credit or debit).

WHAT IS AN EXPERIENCE MODIFICATION WORKSHEET?

An experience modification worksheet is a document that shows how the rating bureau calculated their final E-Mod result. Formatting varies by bureau, but the following data is typically included on all E-Mod worksheets:

1. Name of the employer(s) or business(es)

2. State where the business is located (can be multiple states)

3. Risk Identification Number (Bureau ID #)

4. Date the E-Mod was calculated by the rating bureau

5. The date the E-Mod can be applied to the policy (known as Anniversary Rating Date (ARD) or Rating Effective Date)

6. Payroll (exposure)

7. Classification code(s)

8. Expected Loss Rate (ELR); (amount of expected losses for the classification per $100 of payroll)

9. Expected Losses (ELR multiplied by the payroll divided by $100)

10. Discount Ratio (D-Ratio); (portion of total expected losses that are expected primary losses)

11. Expected Primary Losses (expected losses by multiplied the D-Ratio)

12. Expected Excess Losses (expected losses minus expected primary losses)

13. Actual claim data: claim number, injury type, status (open or closed), actual incurred loss amounts (total and primary/ excess amounts).

14. Ballast value/Stabilizing value

In short, actual losses are compared with expected losses to determine whether a credit (decrease) or debit (increase) E-Mod is generated. The experience modification worksheet shows the math behind this calculation.

WHO CALCULATES EXPERIENCE MODIFICATIONS?

Experience modifications are reviewed, calculated, and published by a rating bureau. Each state has either assigned an independent rating bureau or is a member of a national council who produces E-Mods for multiple states.

Founded in 1923, The National Council on Compensation Insurance (NCCI) represents the largest number of states as their rating and data collection bureau. In addition to experience modification review, NCCI provides insurance professionals information related to classification, industry trends, and loss cost recommendations. NCCI also provides an assigned risk marketplace for hard-to-place accounts operating in the states they represent.

The following states’ insurance departments have designated NCCI as their licensed rating bureau:

Alaska (AK), Alabama (AL), Arkansas (AR), Arizona (AZ), Colorado (CO), Connecticut (CT), Washington DC (DC), Florida (FL), Georgia (GA), Hawaii (HI), Iowa (IA), Idaho (ID), Illinois (IL), Kansas (KS), Kentucky (KY), Louisiana (LA), Maryland (MD), Maine (ME), Missouri (MO), Mississippi (MS), Montana (MT), Nebraska (NE), New Hampshire (NH), New Mexico (NM), Nevada (NV), Oklahoma (OK), Oregon (OR), Rhode Island (RI), South Dakota (SD), South Carolina (SC), Tennessee (TN), Texas (TX), Utah (UT), Virginia (VA), Vermont (VT), West Virginia (WV).

The following states have designated an independent insurance rating bureau:

California (CA) - Workers’ Compensation Insurance Rating Bureau of California (WCIRB)

Delaware (DE) - Delaware Compensation Rating Bureau, Inc. (DCRB)

Indiana (IN) - Indiana Compensation Rating Bureau (ICRB)

Massachusetts (MA) – Workers’ Compensation Rating and Inspection Bureau of Massachusetts (WCRIBMA) Michigan (MI) - Compensation Advisory Organization of Michigan (CAOM)

Minnesota (MN) - Minnesota Workers’ Compensation Insurers Association (MWCIA)

North Carolina (NC) - North Carolina Rate Bureau (NCRB)

New Jersey (NJ) - NJ Compensation Rating & Inspection Bureau (NJCRIB)

New York (NY) - New York Compensation Insurance Rating Board (NYCIRB)

Pennsylvania (PA) - Pennsylvania Compensation Rating Bureau (PCRB)

Wisconsin (WI) - Wisconsin Compensation Rating Bureau (WCRB)

The following states have adopted a monopolistic model:

North Dakota (ND), Ohio (OH), Washington (WA), Wyoming (WY)

These states prohibit employers from purchasing workers’ comp insurance from private insurers. Businesses are required to obtain coverage through a state government-operated fund. They do not use NCCI for E-Mods, but may refer to them as an advisory organization.

HOW IS AN EXPERIENCE MODIFICATION CALCULATED?

Each state rating bureau calculates experience modification factors a little differently. However, there are some overarching trends used across the board.

To calculate an experience modification, rating bureaus use actual loss history from the three years prior to the expiring term. For example, to calculate a 2022 experience modification, claims data from 2020-2021, 2019-2020, and 2018-2019 would be used. 2021-2022 data would be excluded as claims data is often not fully developed during or immediately after a policy term ends.

Additionally, to compare data to risks of a similar size and type, rating bureaus develop expected loss values for each classification based on statistical data collected for each class code. The expected loss values are developed per $100 of payroll, so that size of risk is considered as well. Trends are analyzed continuously, and most rating bureaus update their expected loss values at least once per year.

Workers’ compensation coverage is intended as the sole remedy for injury or illness sustained in the workplace. Therefore, some claim costs are excluded from the E-Mod calculation. After all, accidents are anticipated.

Examples:

1. Medical-only claims—in which the employee does not miss any work or returns to work within the state determined waiting period—may be included at only 30% of the total claim cost.

2. A split point is determined by each state, which means that less weight is given to claim dollars over a certain amount. Any claim dollar over the designated split point is discounted prior to inclusion in the E-Mod calculation. A split point allows for emphasis on frequency of claims, as opposed to severity of claims. Primary losses (amount under the split point) have a greater impact on experience rating and reflect frequency. Excess losses (amount per claim over the split point) have a lesser impact and reflect severity.

Finally, a stabilizing value is used in the formula as to help prevent the E-Mod from generating too far above or below 1.00. The intention is to stabilize the impact of one single loss on the experience modification. The stabilizing value is a combination of the ballast factor and the weighted discount given to expected excess losses.

To compute the stabilizing value, NCCI calculates the following: (Expected Excess Losses x (1 - weighted discount factor)) + ballast factor.

The ballast value is determined by the rating bureau and changes in relation to the size of the company and the expected losses.

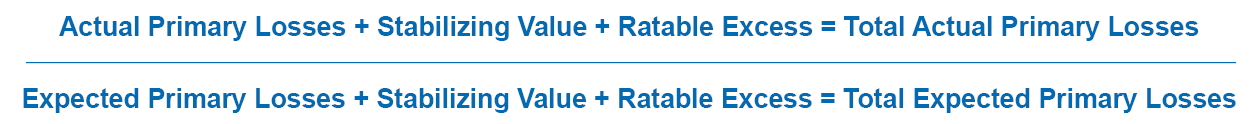

Find below an abbreviated version of the formula used by NCCI to calculate experience modification factors:

The formula compares an individual employer’s loss experience with an expected loss value developed by the rating bureau. Ultimately, the experience modification generated reflects claims history in relation to the insured’s peers.

If an insured’s E-Mod is 1.0, claims history is average among similar businesses.

If an E-Mod is less than 1.0, claims history is better than insured’s peers. This is considered a credit mod and will result in a reduction of rate when applied to the base rate for each classification.

If an E-Mod is more than 1.0, claims history is worse than insured’s peers. This is considered a debit mod and will result in an increase to rate when applied to the base rate for each classification.

The experience rating factor is intended to reward businesses who emphasize safety, timely reporting and response to incidents, as well as a strong return to work program because, in theory, these procedures will lead to lower claim costs.

Learn more in part 2 of this Q&A, E-Mods: Beyond the Basics!

Please reach out to RT Specialty’s knowledgeable workers’ compensation team for additional information regarding experience modifications and other work comp related questions.